Metalcasting Growth Strategies I: Setting the Stage for Growth

Foundry is a tough business. Surviving, let alone achieving, long-term growth, is challenging. The goal of this series is to provide some perspective and tools that foundries may use to develop sustainable, profitable growth. The vantage point is my experience first as a supplier to the global foundry industry, and more recently as a strategist in the metalcasting sector. I have attempted to frame the challenges and opportunities for growth specifically for foundries, using a number of tools and techniques used by strategists.

This article sets the stage by taking a look at the big picture. These are observations that I believe are important for defining the boundaries in which most foundry growth strategies must be derived and delivered.

Observation 1: 'Foundry' is not an industry. Let's get something straight: "foundry" is not an industry. A foundry is a place where castings are produced, or the process that transforms molten metal into a cast metal part. Referring to foundry as an industry has strong and historic precedent, probably originating with the pre-industrial age craft guilds, and promulgated today by the fraternity of foundrymen and trade associations.

To be clear, the foundry process is unique and referring to 'foundry' as an industry is useful in many ways. However, from strategic perspective, focusing on foundry as a place and a process makes us too internally focused, and prone to miss a bigger picture. It creates a "if we build it, they will come" mindset for the business. Instead, our approach should start be "what should we build, market, or sell."

Referring to metalcasting as the market gets us closer to what's needed as the basis of a growth strategy. Better yet, careful segmentation of end-use markets and sub-segments is necessary to gain the best understanding of the most substantial growth opportunities.

Observation 2

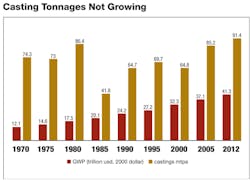

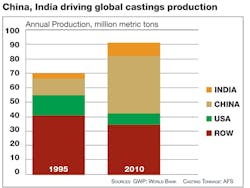

Observation 2: Metalcasting is a slow-growth sector overall, but there always are some segments growing rapidly. Overall, demand for metalcasting s has been growing at about 0.52% on a tonnage basis over the past 40 years. By comparison, overall global growth has averaged about 3.1% over the same period. While castings are important to society, their importance relative to everything else has been diminishing.

Even the high-growth sectors for castings, are in reality not so high. Aluminum castings have grown at 4.2% annually on a global basis since 1975.

While metalcasting is a low-growth market overall, there are always casting markets growing at substantial rates. Finding and participating in these markets can be the key to a foundry growth strategy.

Observation 3

Observation 3: Commodities inflation is not growth. While metalcasting volumes grow slowly, metalcasting prices can give the appearance of a growth industry thanks to the price increases caused by inflation in metal commodities. Looking at the U.S. as an example, aluminum casting production has grown at 4.2% on average from 1975. Meanwhile, aluminum metal costs during the same period reveals that the unit value of aluminum metal had increased by three to four times, placing the apparent growth in revenue for aluminum castings into double digits. More recently, the value of iron castings has skyrocketed due to the underlying inflation of scrap and other production materials.

When commodities inflation can be passed along to customers, including the extra costs associated with financing the working capital, commodities inflation can be a good thing for metalcasters. But, commodities inflation is only temporary respite for metalcasters when the supply of castings is tight. Worse, commodities inflation poses a huge risk for metalcasters to assume as the cost of doing business with strongly positioned OEMs.

Observation 4

Observation 4: Large bursts in building infrastructure distort underlying castings demand, and also lead to production overcapacity. Metalcasters are rightly proud to talk about how fundamental castings are to modern life. Especially during periods of rapid infrastructure build-out, huge amounts of castings are required, either as part of the infrastructure or as part of the machinery needed to build it.

These spurts of infrastructure building offer foundrymen tremendous opportunities for growth. The ongoing transformation of the U.S. energy sector as a result of the implementation of horizontal drilling technologies for shale gas may be transformational for a generation of metalcasters. The requirements for drilling and producing the gas are obvious. But, perhaps more important are the castings required to transport, liquefy, store, ship, and use the gas. Importantly, the U.S. now has the cheapest energy outside the Middle East, and apparently in great abundance. The process of converting from coal-fired to gas-based operations has utilities consuming castings at a voracious pace. Manufacturing activity is surging in the petrochemicals market due to the cheap raw material position, creating demand for pumps, compressors, and other castings-rich equipment. It's conceivable that energy-intensive industries that left the U.S. long ago could return.

Infrastructure build-out has some negatives for the foundry sector. For example, foundry capacity built to meet infrastructure demand outlasts that demand, creating potential overcapacity that will last a long time. The steel industry provides a helpful illustration. At the beginning of its infrastructure build-out in 1880, the U.S. annual capacity for steel castings was estimated to be 768,700 tons, exceeding total steel castings production in the U.S. in 2009!

The most massive infrastructure spend in history seems certain to unfold over the next 20 years. Estimated investments for energy, water, and transportation infrastructure – all huge castings markets range as high as $40 trillion. As a result, opportunities as well as threats abound for North American foundrymen.

Observation 5

Observation 5: Castings float. Perhaps the most important insight I gained while managing a global castings consumables business was that "castings float" from one country to another. For example, when the Chrysler foundry in Indianapolis shut down, the castings requirements of Chrysler didn't disappear. Rather, production simply "floated" to Mexico and Brazil. For a global supplier the challenge was to follow the floating castings.

Floating castings can distort perceptions of growth within countries significantly. In the Chrysler example, the demand for castings remained in the U.S. – only the supply disappeared. Likewise, the huge increase of castings "floating" south did not represent new demand in the global market. Understanding floating castings is critical to developing growth strategies for foundries.

Observation 6

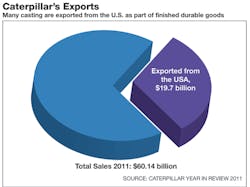

Observation 6: Huge amounts of castings are exported incognito. Foundrymen around the world agonize about imported castings. Even Indian foundrymen lobby continually for increasing tariffs on imported Chinese castings! Foundries in Low Cost Countries crave casting export opportunities. Yet, in terms of a growth strategy, the much larger story is the huge volume of castings being exported and imported in the form of tractors, earthmoving equipment, cars, machine tools, pumps, valves, and compressors, to name a few.

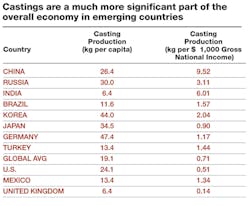

Perhaps this point is made best by looking at castings production per capita. On average, the world consumes annually about 19 kg of castings per capita. But, countries such as Germany, Japan, and Korea, produce more than twice this amount of castings per capita. The explanation does not take long to sort out, at least qualitatively. The excess of castings over domestic consumption is exported globally. Korea may be the best example of this: fully 70% of all cars produced in Korea are exported. Cars made in Korea contain far more casting exports than total exports of raw and machined castings from Korea.

To the extent that the manufacturing environment improves in the U.S. relative to everywhere else for the OEMs producing these durable goods, recognizing this factor has potentially huge implications for foundries' growth strategies.

Observation 7: The customer base for castings is consolidating. Foundrymen are well aware of the extraordinary power of OEMs in negotiating their purchase of castings, due to their comparative size and purchasing power. The trend toward consolidation among the OEMs has only accelerated in recent years, and is likely to continue.

This dramatic consolidation among consumers of castings will perhaps drive even more profound changes for foundrymen than any other trend. While this could be viewed negatively by many foundrymen, others will see it as a significant opportunity, or at least an inevitability to be factored into their growth strategies.

Slow growth, highly variable costs, floating markets, overcapacity, stealth imports and exports, consolidating customers – this is a challenging environment for any business. Especially given the challenging environment of foundry, attention to strategy is a necessity, not a luxury. Fortunately, there are useful approaches for developing and implementing growth strategies even for the foundry environment. In the subsequent installments to this series I will explore these approaches to address growth strategies specifically for foundries.

Mike Swartzlander is the Managing Director of Cast Strategies LLC, which provides consulting services on growth strategies to manufacturers in the metalcasting s, specialty chemicals, and composites parts markets. Visit www.cast-strategies.com.

About the Author

Mike Swartzlander

Founder & Managing Director

Mike Swartzlander is an accomplished executive with more than 37 years’ experience and a focus on building and implementing global growth strategies. Prior to starting Cast Strategies in 2009, Mike served as Ashland Inc.’s first Managing Director in India. Previously, Mike served in a number of leadership positions at Ashland, including Vice President of Ashland Inc., General Manager of Ashland’s global castings consumables business and management positions at the company’s composites and electronic chemicals businesses. Prior to Ashland, Mike held management positions at Union Carbide Corporation and the Tate & Lyle Co. starting numerous specialty chemical businesses in the U.S., Asia and Europe.

Mike is a Past Officer of the American Foundry Society, Past President of the Foundry Educational Foundation and remains active in the industry as a speaker and author.

Mike is active in trade associations both in India and the USA, where he has been a speaker on numerous occasions and has been awarded the prestigious Ray H. Witt Management Award twice by the American Foundry Society for presentations at Casting Congresses.

About Cast Strategies LLC: Cast Strategies LLC is a trusted advisor to the global business-to-business castings, chemicals and materials industries, helping companies develop and implement robust strategies to deliver sustained profitable growth. Learn more at www.cast-strategies.com.