As 2011 recedes we find ourselves in familiar circumstances, confused about the economic future. Credible forecasts from financial institutions and name-brand economists contemplate a remarkable string of calamities emerging from bewildering circumstances in the Europe economy, everything from financial defaults by EU member countries to a complete collapse of the Union and dissolution of the Euro currency. At the same time, the long-steady Chinese economy suddenly seems a bit vulnerable thanks to an overvalued housing market. And in the U.S. economy, debt, unemployment, and weak consumer activity continue to depress economic growth — the same triad of problems that emerged more that three years ago. The world craves clarity, and almost nothing is clear.

One thing is clear: domestic metalcasters are bullish on their prospects for 2012. Even within worldwide economic chaos some hard realities endure, such as the need for castings of innumerable variety to build and maintain the basic assets of modern life. Domestic foundries in 2011 have benefited from the market’s need for their products. “Business has been reasonably good,” one metalcaster concluded for us in comments following the annual Foundry Management & Technology Business Outlook Survey, citing “ongoing price increases” as a further development over the past year.

“Our business has increased dramatically (over 30%) this past year,” another respondent indicated. “Increased infrastructure spending on electrical transmission and fire fighting components has increased (our) business.” Getting to this point has not been easy, and problems remain.

Getting ahead demands effective and creative strategies. “We are re-consolidating after the loss of a considerable number of our competitors,” a respondent explained. “The simpler, less complex types of castings will continue to be sourced in a lower-cost supplier market. Metalcasters that offer added value will be more competitive than raw castings suppliers.

Having been presented with the competitive pressures of a global economy well before financial uncertainty gripped the world over three years ago, manufacturers know that facts matter more than predictions. Metalcasters, above all, know that they have to anticipate problems and plan for success under any conditions. More than that, they are informed well enough about their work and our world to understand the factors influencing both of those — from the percentages that determine success or failure on the melt deck, to the issues shaping the global manufacturing economy. The understand acutely how the global economy impacts their industry.

Throughout September and October we surveyed FM&T readers, identifying as nearly as possible the most senior individual at each metalcasting location in our circulation. The resulting information is a reliable template of circumstances in the foundry and diecasting industries in 2011, and those operators’ expectations for business in 2012.

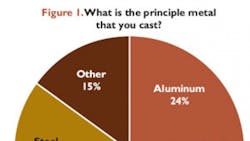

The respondents offer a fair representation of the metalcasting industry: 24% manufacture aluminum castings or diecastings as their principal product; 18% produce steel castings; 17% produce gray iron castings, and another 17% produce ductile iron castings; while the remainder produce brass or bronze castings (9%), or casting in some other material (15%) as their primary products.

The survey also reflects a useful balance of metalcasting organizations: 19% of all respondents employ more than 250 workers; 21% have 100-249 employees; 19% have 50-99 employees; 16% have 20-49; and 25% have fewer than 20 workers.

Growing confident

The expectations for growth among metalcasters in our survey is evidence of two things: strong demand for castings sustained over the past year, and confidence gained by operations that have weathered the market pressures and consolidations of the past three years. It’s not a universal outlook, but the results show there is decisive optimism about increasing volumes of casting shipments across all categories of respondents. Whereas just 4% expect their deliveries to decrease in 2012, fully 55% expect their volumes to rise and 41% foresee activity being “about the same” as in 2011.

Looking in greater detail at this point, the highest level of improvement in shipments is expected by ferrous foundries:

75% of the respondents that produce steel castings see their delivery levels rising next year, while 67% of ductile iron casting producers and 57% of gray iron foundries expect improvements in the coming year.

Aluminum casting producers are generally positive about the coming year, too: 46% see shipments rising and 45% see them remaining even. By contrast, the brass/bronze casting producers are containing their enthusiasm about 2012: just 23% of these foundries expect any increase in casting shipment volumes in the next year.

Examining their optimism in terms of plant size, we discern that the smaller foundries (63% of those with fewer than 20 employees) are at least hopeful that shipment volumes will remain the same in 2012 as they have been this year, and 32% expect those volumes to rise. Otherwise, foundries of all sizes expect shipments to increase in the coming year: 54% of plants with 20-49 workers; 60% of plants with 50-99 employees; 57% of operations with 100-249 employees; and 78% of those with more than 250 workers anticipate higher levels of shipments next year.

Investment planning

Nothing demonstrates optimism like capital spending, and Outlook survey respondents are unquestionably ready to spend. While most respondents indicated they would maintain 2011 investment levels in the coming year, a sizable minority (38%) will increase spending totals. These results are evenly balanced among metalcasters across the material range, and across all plant sizes. Most of the capital is aimed at new process equipment (63%) or facility improvements, though there will be some considerable number of facility expansions (23%) and at least seven (3%) new plants under construction.

Notably, 33% of survey respondents indicate their operations are carrying no debt at this moment, and only 7% expect to increase their borrowing levels in 2012.

As to the implications of their capital investments, of the nearly 300 respondents to the Business Outlook survey, 30% identified cranes and hoists, 28% pointed to melting equipment, and 27% named grinding equipment as targets for their investment capital — supporting the impression that metalcasters expect to increase production volumes in 2012.

A second tier of investment spending plans highlights the importance of regulatory compliance and product quality: 25% of respondents will invest in new laboratory equipment, 25% will invest in pollution controls; and 23% will target testing and inspection systems. Relatedly, 22% will invest in new sand reclamation equipment, a choice that suggests environmental, maintenance, and cost-saving objectives.

Still another investment priority is greater plant and process efficiency: as indicated, 30% of respondents will invest in new cranes and hoists, while 24% are planning to buy new lift trucks or loaders, and 18% will invest in new robots and/ or manipulators.

No illusions

For all their documentable optimism, our respondents are clear-headed about the factors that will challenge their organizations and operations in 2012. Dominating this list are many of the same problems identified as being the most pervasive in 2011. Across the board, respondents recognize a series of issues that will present the most significant obstacles to their success in the coming year, and each of these points to the rising cost of manufacturing:

• 40% of all respondents anticipate energy-cost problems in the coming year, though only 4% foresee energy shortages, indicating any problems ahead are not related to supply or demand, but to some other factors, such as the inflationary effect of taxes on energy.

• 36% of respondents expect raw-material costs to impact their chances for success in 2012, demonstrating that the challenge presented by global competition is not only for market share but also for the goods and materials that make metalcasting possible.

• 34% of those surveyed pointed to medical and insurance costs, followed closely (at 31% of all respondents) by EPA requirements. The reading of these results is simple: along with “OSHA requirements” at 23%, metalcasters recognize the growing difficulty of managing and complying with regulatory requirements.

On the perennial problem of casting imports, there is, surprisingly, nearly a three-way draw: 32% see no effect on their business because of competition from imported castings; 30% say casting imports are having an increasing impact on their business; and 33% report that casting imports are becoming less of a competitive factor. It is no surprise that opinions on this point remain as fulsome as ever: “How can Chinese casting manufacturers sell castings below U.S. foundry material costs?” one respondent wondered. “Either U.S. foundries are being overcharged by vendors, or China is underwriting casting cost.”

Many other respondents used the invitation to comment to offer a range of opinions on recruitment, regulation, immigration, and, of course, politics. With a Presidential election year ahead, the debate is well underway among metalcasters.

But the more relevant question for domestic foundries and diecasters heading in to 2012 is their outlook for the U.S. economy. There is little hope among our respondents (just 3%) for a dramatic rebound in economic growth, but 77% expect economic conditions to improve somewhat (34%) or stay about the same (43%), and only 21% foresee worse conditions (decline somewhat, 15%; decline dramatically, 6%) in the year ahead. With all that is going on around them, and us, that is a reason to be optimistic.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries. His work has covered a wide range of topics, including process technology, resource development, material selection, product design, workforce development, and industrial market strategies, among others.