Questions, questions, questions. To be in manufacturing today is to be presented with a new series of questions every day, from verifying the quotidian details of production processes to addressing comprehensive issues that shape an organization. And, each December the questions take on an existential tone: What have we accomplished? Where are we headed next? At this time of year the objective is not to resolve new questions but to find new ways to answer ongoing challenges — achieving and maintaining profitability, growing market share — effectively.

We start the questioning early, conducting the annual FM&T Business Outlook Survey of metalcasting executives, managers, and operators by e-mail during October. This year the survey elicited an impressive response total of 326 individuals.

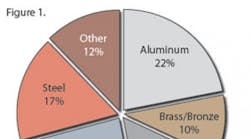

The survey respondents include representatives of the entire domestic metalcasting spectrum, including producers of aluminum, brass and bronze, ductile iron, gray iron, steel, and other metals (see Figure 1.) In addition, they are a reliable representation of the industry in terms of operation size (defined here by the number of employees (see Figure 2.)

The general purpose of our annual survey is to gauge the impressions of individuals who are actively involved in metalcasting, about current and near-term business conditions. In this sense, the defining issue of the survey presented in two questions: “How will your 2010 casting shipments (tonnage) compare with 2009 shipments?” (see Figure 3), and “How do you expect your 2011 casting shipments to compare with 2010 shipments?”

Better or worse?

With 10 months of data available to them, our survey respondents were decisive (57%) in their conclusion that their 2010 shipments will improve over their 2009 results. 2009 was a historically bad year for business in general and manufacturing in particularly, but it seems relevant to point out that in FM&T’s 2010 Business Outlook Survey, conducted in October 2009, only 9% of all respondents were able to predict that they would improve their results over the previous year.

However, that 27% of this year’s responders see their results remaining essentially even with 2009, and that 17% see 2010 as a decline over last year, suggests that the metalcasting sector is not recovering from 2009 in an even fashion. A closer examination of these results suggest that the optimism is most commonly shared by producers of gray iron, aluminum, and steel castings — possibly an indicator of improving prospects for automotive foundries.

The more pressing question in the current survey is the one that looks ahead: “How do you expect your 2011 casting shipments to compare with 2010 shipments?” Once again, the result is decidedly in the most optimistic direction, with 54% anticipating an increase in casting shipments during the coming year, and 41% seeing a continuation of the same 2010 conditions prevailing. Just 4% of all respondents see shipment levels declining in 2011.

In more detail we see again that the most optimistic of our survey respondents are those producing castings in aluminum, gray iron, and steel. The respondents who anticipate more of the same in 2011 are fairly evenly spread across the metal categories, and the very small number of respondents who forecast a decline in shipments are similarly distributed.

Also interesting to note is the way that responses to this forecast question are distributed according to the size of operations. To review, the overall response finds 54% of those surveyed expect an increase in 2011 shipments versus 2010, 41% expect more of the same, and 4% their expect shipments to decrease next year. The optimism is evenly shared by operations of all sizes, but it’s slightly more likely to be found in operations with 20 to 49, 50 to 99, and 100 to 249 employees. The no-change outlook is most common among plants with 20 or fewer employees, and though they are a small element of the whole, those expecting a decrease in shipments also are likely to be the smallest operations.

Size factors

Optimism about the future does not necessarily transfer into actions. While most of our respondents see casting shipments rising in 2011, such a positive outlook does not seem to encourage plans for new capital investments. Asked “How, and by what percentage, will your 2011 capital expenditures compare to your 2010 capital expenditures?” (see Figure 4), 59% of all respondents indicated their investment total will remain unchanged; 32% of respondents will increase their spending total; and 9% will decrease the value of their plans.

Within the frame of this question, it’s worth studying again the profile of our respondents’ metalcasting operations. Of those foundries planning to increase capital spending next year, a majority (32.4%) are gray iron operations, followed closely by steel foundries. However, among the 30 foundries that plan to decrease capital spending next year, the gray iron plants also lead the pack.

Among those planning to increase capital spending in 2011, a decided majority (47%) are metalcasters with 100 to 249 workers. The remaining foundries with plans to increase their investment are rather evenly distributed among the other employment-size groups.

Plants that plan to decrease their 2011 capital investment plans are more likely to have less than 20 employees, though the totals 17are more evenly distributed among plants of all sizes.

Following the money

While most survey respondents do not plan to increase capital investments in 2011, there are spending plans in the works: 57% of the respondents plan to purchase new equipment, 19% plan to expand their existing operation, and 2% (seven respondents) indicate plans to build new metalcasting plants in 2011. Just over one-third, 34% of the total or 110 of all respondents, indicate they will have no capital expenditures in 2011.

But, for the other 66% the planning continues, and it covers a range of processes and equipment. (See Figure 5; note that respondents were invited to identify more than one category of 2011 capital spending.)

Among all these responses, the most likely (26%) object of metalcasters’ 2011 investments will be melting equipment, followed very closely by cranes and hoists (24%), which tied with lift trucks and loaders (24%). These choices were followed by grinding equipment (20%) and pollution controls (19%) to comprise the top five choices for metalcasters’ 2011 capital spending plans..

The problem areas

We use the Outlook Survey to gauge metalcasters’ sense of the problems in the industry, and their assessment of 2010 reveals a sense of their daily challenges and long-term concerns. (See Figure 7; note that respondents were invited to identify more than one area of concern.) Their most commonly cited problem (45%) has been a lack of orders, followed by medical/insurance costs (40%), raw materials costs (39%), energy costs (29%), and imported castings (27%.) Other issues scoring high among the respondents’ concerns were workers’ compensation costs, EPA and OSHA requirements, capital availability, and on-time delivery of castings.

And does 2011 offer any brighter prospects on these matters? Our survey respondents identified numerous areas where they anticipate “major problems” in the coming year, topped by medical/ insurance costs (43%). Raw materials costs (35%), lack of orders (31%), energy costs (30%), and imported castings (26%) complete the top five concerns about 2011. EPA requirements and workers’ compensation costs tied for sixth place (24%), followed by OSHA requirements, capital availability (17%), and training (14%) finish their list of future challenges.