2014 Outlook

Officially, the numbers are sound, and they have been positive for much of the past year. The Institute for Supply Management reported the U.S. manufacturing sector expanded in October (latest data available) for the fifth straight month, and the overall domestic economy grew for the 53rd straight month, according to their Purchasing Managers Index (PMI) of economic activity. That widely regarded study is the benchmark for gauging U.S. economic activity because it surveys of 400 purchasing managers to track production levels, volumes of new orders, rates of supplier deliveries, inventories, and employment levels.

“The PMI™ registered 56.4%, an increase of 0.2% age point from September’s reading of 56.2%,” explained Bradley J. Holcomb, chairman of ISM’s Manufacturing Business Survey Committee. The PMI measures trends, so consecutive months of positive activity are particularly

Holcomb noted the PMI has increased progressively every month since June, and October’s reading brought out the peak of activity in 2013. New Orders and Production indexes have shown particular durability.

But the range of sources ensures that the PMI survey also locates where economic activity is happening, or not. So, while “growth” is indicated across 14 of the 18 industries surveyed for October (including among others Appliances & Components, Transportation Equipment, Machinery, and Fabricated Metal Products) two of the industries for which purchasing managers are indicating market “contraction” are close to home: Primary Metals and Miscellaneous Manufacturing. It happens that our annual survey discovered a similar uncertainty about the recent past and the immediate future.

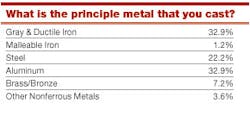

We surveyed readers by email over a period of six weeks. The results include responses from over 150 readers who represent a broad variety of foundries and diecasters: 32.9% name aluminum as the principal metal cast at their operations, and an equal percentage are casting iron; 22.9% are casting steel; 7.2% are casting brass or bronze alloys; and 3.6% are casting other nonferrous metals. Just 1.2% of respondents listed malleable iron castings as their principle product.

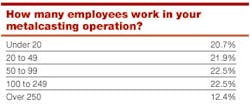

Similarly, our respondents represent metalcasting at various scales, including shops with less than 20 workers, 20.7% of respondents; and plants with over 250 workers, 12.4% of the field. Plants with 20 to 49 workers are 21.9% of the respondents; and an equal proportion of the field is represented by operations with 50 to 99 and 100 to 249 workers — 22.5% of respondents for each. What these readers tell us is the basis of our report.

Weighing the Results

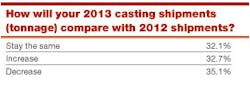

The expanding manufacturing segment revealed by the ISM survey is not nearly as apparent in the Outlook survey. Asked to compare the current year’s shipment volumes, less than a third (32.1%) of the respondents see 2013 shipments improving on the 2012 volume. In fact, the largest portion of all respondents (35.1%) predicted that this year’s total would fall below last year’s result. The percentages are very nearly split three ways, but with a slight edge to the more negative view.

Steel and ferrous foundry respondents were most likely to expect a declining volume for this year’s shipments, though majorities of gray/ductile iron foundry respondents (54.6%) foresee results that are the same or better than 2012’s result.

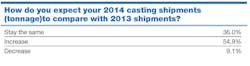

Looking forward, our respondents are decidedly more optimistic; 54.9% expect their shipment totals to increase in 2014, and less than 10% see any decline in shipment volumes. These high expectations were shared among respondents of all casting types, and all plant sizes.

Expectations that shipments will be essentially the same next year as they are now are fairly evenly dispersed among the different metal types and plant sizes. The decreased expectations for 2014 appear to be shared fairly evenly too, generally in the 5-10% range though some categories drew responses that measured higher.

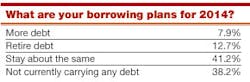

When we asked our readers to forecast the prospects for the overall domestic economy in 2014, a large majority indicated conditions will “stay about the same” (41.8%) or “improve somewhat” (38.6%.) Another minority element (17.1%) expects conditions to “decline somewhat.” Expectations for more significant improvement or decline were less consequential.

Capital Ideas

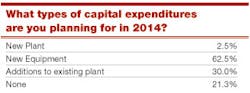

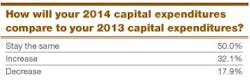

The most tangible demonstration of confidence for manufacturers is capital investment. Among Outlook survey respondents, slightly over 21% reported no capital spending plans for 2014, but of the rest, 62.5% intend to add new production equipment next year.

More encouraging, 30.0% intend to expand their current plant sites, and 2.5% noted their intentions to add new plant sites.

The value of investments our respondents reported will vary widely, though about 30% indicated investments will be valued at $1 million or more: the peak value among these reports is reported to be $40 million.

At the lower end of the scale, slightly more than half of all respondents indicated their investments would cost 200,000, or less.

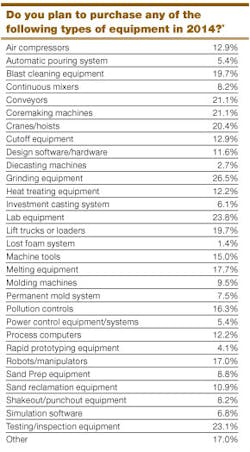

The new equipment that respondents plan to acquire in the coming year is often a reflection of their current needs or concerns. 26.5% of all Outlook survey respondents intend to invest in new grinding systems next year; 23.8% plan to acquire new laboratory testing systems, and 23.1% plant to buy new testing and inspection technologies.

Another notable type of new investments will be those directed at basic metalcasting processes, like melting, coremaking, and molding operations: 17.7% will invest in new melting equipment systems; 21.1% of respondents have plans for new coremaking machinery; and 9.5% plan to invest in molding machinery.

Other high-ranking equipment choices for 2014 will be pollution controls, 16.3%; machine tools, 15.0%; cutoff equipment, 12.9%; and design software, 11.6%.

Toil and Trouble

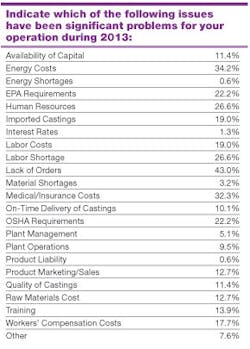

We aim to identify the “pain points” that our readers experienced during the course of the past year – and those problems they expect to face in the coming year, too. It is notable that the most commonly identified problems, “lack of orders” (43.0% of respondents), is a perennial concern for manufacturers. Another common worry (34.2%) for the past year has been “energy costs,” and that too is one that’s likely to have sustenance over the coming year.

The list of problems that rank after these illustrate the ongoing influence of regulation in metalcasting management: medical/insurance costs (32.3%), human resources (26.6%), EPA requirements (22.2%) and OSHA requirements (22.2%). Concerns for workers’ compensation costs have been a significant problem for 17.7% of respondents during 2013.

Difficulties presented by casting imports have long been a concern for metalcasters, and it was named as one by 19.0% of respondents to the Outlook survey. Still, when asked directly about this matter, 34.4% of respondents indicated that casting imports have had no affect on their work, while 33.7% replied that imports were becoming more of a competitive factor for them. 22.7% replied that casting imports had become less of a competitive factor for them during 2013.

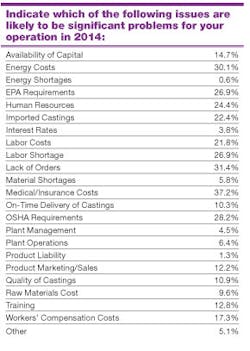

In the months ahead, metalcasters’ most common concern will continue to be a lack of orders (45.2%), followed by foreign competition (38.1%), and then a three-way lock of managerial concerns – energy costs, higher labor costs, and foreign competition, each garnering 28.6% of respondents’ replies.

We recognize the link between productivity and employment, so we asked readers to forecast their plans to increase employment in 2014: while 39.0% indicate they will be hiring new associates in the coming year, 61.0% have no intention of expanding in that way.

Facts are Fluid

Manufacturing has done much to redefine its role in the domestic economy over the past decade, accentuating its creativity and building up its advantages in customer service and market presence. All this has helped to stabilize the industrial economy, as the PMI data demonstrates.

But closer to the action, market segments like metalcasting reveal their own dynamics — advantages and liabilities that are dictated by process requirements and customers’ needs, as well as by a range of outlying factors like energy costs or regulatory standards.

Driving it all is time, and even though it is instructive to know the current conditions, the calendar is always turning forward. For manufacturers the way ahead is never a sure thing. Up or down, improvement or decline, they do their best with the resources and opportunities that the market affords to them.