In the end, it’s the shape that matters, which may be why so many different methods of metalcasting proliferate. Over thousands of years, craftsmen, laborers, and now engineers have filled molds with metal, and the variations in their techniques are the origins for many debates, endless research, and boundless innovation. In the past decade, much of the innovation in metalcasting has been prompted by the industrialization of additive manufacturing.

Of course, additive manufacturing is a wholly separate industry, and like metalcasting it consists of numerous methods and techniques. Even so, there are a number of points — e.g., printing sand molds and cores; forming or repairing molds or tools — where metalcasting and AM technologies coincide. One point of recent convergence involves investment casting patterns, and the materials and processes additive manufacturing can offer for those.

Recall that investment casting is a high-cost, high-value approach to metalcasting. The parts are formed to achieve exquisite precision in form — thin walls, internal shapes and voids; and/or function — turbine engine parts, valves, and surgical implants; and often in critical or exotic alloys.

Time and effort add to the cost of investment casting. The part’s final shape is formed in full detail, typically in wax. This shape, or multiple versions of it, are attached to a “tree”, and then dipped in ceramic slurry that coats and hardens around the wax form. This process is repeated until a hard ceramic shell forms.

Next, the structure is heated to melt the wax cores, leaving a void that can receive molten metal. Once the metal is solidified, the ceramic mold is broken and the casting is released.

This is simplified, but the plain fact is that investment casting takes time to carry out properly, and time is money. “We have the goal of making investment casting patterns as inexpensive as possible,” according to Chuck Alexander, director of product management for Stratasys Direct Manufacturing. That is a 3D-printing and custom manufacturing service provider established by Stratasys — one of the primary developers of industrial-scale additive manufacturing technology.

According to Alexander, “Customers come to us for a variety of reasons, whether that’s to utilize our equipment, expertise, or both. … Owning the largest 3D printing capacity in North America also helps ensure their projects are done on time.”

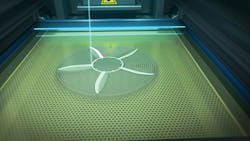

Additive manufacturing (or, 3DP) can be done in many ways, and one of the most common is “stereolithography” (SL or SLA.). In this process, CAD files are converted to .STL format to guide a “printer” (the SL system) to build a 3D structure in successive layers, each one bonded to the preceding one. 3D Systems is one of the primary suppliers of SL technology, with machines capable of producing layers as narrow as 0.002-in., for finished parts with superior dimensional tolerances, smooth surfaces, and fine feature details.

So, it’s becoming clearer why, and how, Stratasys Direct Manufacturing is making investment casting its target market. “Tooling costs associated with wax patterns are eliminated when investment casting patterns are made with stereolithography,” Alexander emphasized. “The bigger and more complex the pattern, the better the value proposition for choosing SL versus wax. Complex parts generally take only one or two weeks to deliver. This allows for foundries to help their customer get to market much faster and at a lower cost.”

But note, Stratasys Direct Manufacturing is not offering to supply wax patterns, but patterns printed in a polymer material it developed.

“Our primary pattern material, SC1000P, is our own formulation we developed to minimize face-coat interactions. There are certain superalloys or reactive metals where antimony can be a factor, so we needed an additional material that removed antimony completely.”

Having partnered last year with Somos, a specialty provider of SL materials, Alexander reported Stratasys Direct Manufacturing has beta-tested a second-generation antimony-free formulation, Somos Element, “to validate and ensure it would deliver acceptable patterns as far as accuracy, robustness, shipping, etc.”

There is more to this change in pattern materials, he added. “We recognize that wax is used for a reason, and we have investigated wax printers. But wax is difficult to ship, and it doesn’t scale well. As components get bigger, wax patterns require chills and other work-arounds. It’s difficult to scale-up and introduce complexities to wax patterns.

Alexander also pointed out specific advantages that SL brings to investment casting pattern production, starting with scalability. “As SL machines develop further, we’ll be able to produce bigger parts in one build. The development of the (additive manufacturing) industry also leaves me to believe that we’ll be able to achieve very small geometries soon.”

He noted that Stratasys Direct Manufacturing has started to produce investment-casting patterns with built-in gating systems, which offers several advantages. First, the time and labor-cost savings to the foundry that no longer has to assemble the gating. Next, there is greater certainty of accuracy without manual assembly. And, the chance to review and revise the gating design in CAD adds to the process reliability.

“We’re seeing more of this because we’re driving costs out of our pattern-making, and gating systems built with patterns are more cost-effective for the foundries,” he reported.

The design and cost advantages of SL-printed patterns are even more attractive in combination with the service that Stratasys Direct Manufacturing is offering. For some smaller patterns, Alexander noted his group can ship hundreds of finished pieces per week. “It’s dependent on the size and complexity of the pattern,” he explained. “The largest, most complex patterns can take one to two weeks. The only thing that really slows down the process is if a unique surface finish is needed. We’re working to develop our as-printed surface finishes to reduce labor and increase speed.”

The “CAD direct” aspect of SL technology is an important one. “There’s nothing to get in the way of ‘design-to-part’,” Alexander said. “Provided that the foundry has worked with their customer to ensure the design is going to work, we directly print designs from the software.”

Resources and experience ensure accuracy of the parts. Stratasys Direct Manufacturing has CNC capabilities and expertise at pattern production, which help to streamline its processes.” With our in-house machining and assembly jigs and fixtures, we can deliver large parts that are highly accurate,” he said, “and we often work with foundries to identify accuracy issues that may occur if they’re new to SL patterns.”

Any problems related to a pattern that may develop can typically be addressed by the flexibility inherent to additive manufacturing. “With CAD direct printing and no wait times for tooling, it’s easy to create new iterations. With foundries, there’s just minimal review time to ensure its capabilities,” Alexander opined. “Design complexity is a key benefit of additive manufacturing. Resolution and minimum feature size possible in SL is actually better than the abilities of poured metal. It’s dependent on the foundry to say whether metal will flow into a complex feature.”

The applications for SL-produced patterns cover much of the landscape familiar to investment casters. “In transportation and aerospace, we see a lot of commercial jet engine parts, turbo charging housings, and avionic boxes with very thin walls,” Alexander reported. “A lot of applications are possible because of what SL can achieve and our capabilities in-house. SL patterns can be assembled around cooling lines and around ceramic cores for fine holes – the possibilities really are enormous.

“Applications lately have been impacted by the antimony-free material that now allows for applications in those specific metals,” he added, but he also maintained that his group’s experience and expertise are the principal selling points.

“The foundry tells us the application, and they may have their doubts about SL’s capabilities, but we’ll work with them to find a solution. Cost-effectiveness is always a factor, but there are many advantages that come with using SL for investment casting.”

The compatibility of metalcasting and additive manufacturing remains a matter of finding common applications. “With diecasting and permanent mold casting there isn’t much impact yet from additive manufacturing,” according to Alexander. Sand casting is a slow-developing market for AM, because the costs of the technology do not match well with the cost structures of sand casting foundries. He said Stratasys Direct Manufacturing is still investigating its options for supplying printed sand cores and molds.

Foam patterns can be produced with SL systems, but Alexander said his group has not identified the “value proposition” of supplying lost foam casting foundries.

And then there is the possibility of producing printed metal parts. According to Alexander, that AM technology is an opportunity, and a threat to investment casting operations.

“Direct metal is a good option for much smaller, complex parts and systems than investment casting may allow,” he said. “Investment casting foundries should be aware of direct metals when speaking to customers, because it’s great for verifying design and helping their customers get to market faster.”

That is an indicator of the shifting landscape in metalcasting and additive manufacturing, and in the evolving universe where the future high technology and precision parts is taking shape.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries. His work has covered a wide range of topics, including process technology, resource development, material selection, product design, workforce development, and industrial market strategies, among others.