Refractory products are a direct indicator of industrial demand — not a leading indicator, like interest rates or scrap metal; nor a lagging indicator, like unemployment statistics or consumer confidence indexes. Because refractories are essential to producing critical materials (like castings), and the consumption of refractories correlates directly to the volumes of metal that is melted, handled, and processed, demand for refractories indicates the direction of growth in manufacturing. According to new research, the outlook is positive.

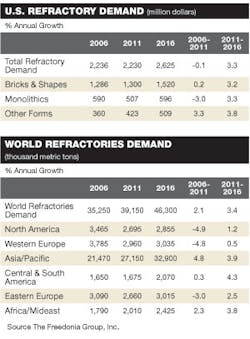

The Freedonia Group Inc., an industrial market research firm, forecasts that demand for refractory products in the U.S. will grow at a 3.3% annual rate through 2016. The information is contained in a 242-page study, now available for sale.

These increases in domestic demand for refractories will be centered in domestic steel production, which is predicted to increase over the next three years. In 2011, sales of refractories to iron and steelmakers totaled $990 million, representing 45% of all refractory sales. After declines in domestic steel production that started with the 2008 global recession, U.S. steel manufacturing and associated refractory demand is forecast now to rise through 2016.

Also prompting increases in refractories demand will be a strong rebound in nonresidential spending through 2016, Freedonia reports, which will prompt increases in production of ceramics products and glass. Output from such industries will rebound as the U.S. economy continues to grow, fueling related refractory demand.

Nonmanufacturing markets will spur demand growth, too, including waste-to-energy plants, traditional power plants, and commercial ovens, though Freedonia notes these markets are all somewhat small.

The largest increases in refractories sales - more than 50,000 tons through 2016 - will be in the engineering contractors market, which also endured declines during the 2006-2011 period.

Importantly, the researchers note that a shift in consumption toward higher-priced, advanced products will boost the value of refractories sales, but future demand will be restrained by the development of longer lasting, more durable refractories. “Most materials manufacturing industries have reduced their per-production-unit consumption of refractories by using newer, more durable products and improved processes,” according to Freedonia.

In cash terms, the fastest growing markets for refractories will be among producers of nonmetallic minerals, including ceramics, glass, and cement.

Monolithic Gains

In terms of value, market gains for refractories will be led by monolithic refractories and specialized shapes. The performance of monolithic refractories has improved significantly, Freedonia noted, and technology advances have made specialty shapes more cost effective and efficient. Demand is seen increasing for each of those product classes.

Buyers increasingly are choosing more expensive high-grade refractories, including products formulated for specific operating conditions. This will result in demand for non-clay refractories in tons outpacing demand for clay-based products, based on performance.

However, Freedonia predicted that sales of clay refractories will shift toward higher grades, which means that demand for clay-based products (in dollar terms) will rise at a faster pace than sales of non-clay refractories.

In a separate study, Freedonia Group forecasts global demand for refractories will expand by 3.4% to a total volume of 46.3 million metric tons by 2016. Product sales will increase 5.3% annually to $46.5 billion through that period, which is less than in previous periods due to moderation in raw material costs and refractory prices. Iron and steel markets will represent more than 60% of global refractory sales by 2016, the study finds.

The analysis of the global refractory market is a 448-page study also available from by The Freedonia Group.

In regional terms, the Asian/Pacific market will lead the world’s demand for refractories, followed by Africa/Middle East, Central and South America, and Eastern Europe.

China, which produces a substantial volume of all the steel produced in the world, will account for more than 70% of all refractory volume gains between 2011 and 2016. Other industries will contribute to China’s demand for refractories too, including cement production, and other general manufacturing industries. (Use of less sophisticated production methods in steelmaking and other industries accounts for a higher volume of refractory consumption, the research firm noted.)

Refractory consumption will rise in the Eurozone and Japan, too. Manufacturing increases in those regions (as in the U.S.) will drive higher refractory demand because the more efficient production technologies make it difficult to reduce marginal consumption of refractory materials. However, refractory consumption in the more developed economies will be concentrated in more costly, high-quality products, so that by 2016 the U.S., Western Europe, and Japan will account for a larger share of the world refractory market total in terms of cost than in tonnage.