Superior Industries International Inc. plans to build a new aluminum wheel plant in Mexico and has budgeted $125 million to $135 million for the project. The news was announced as part of Superior’s 2012 financial results, in which it reported net income of $30.9 million, less than half the $67.2 million net income for 2011.

“The net income decline largely reflected a swing to income tax expense of $3.6 million in 2012 from a $25.2 million income tax benefit in 2011,” according to the statement.

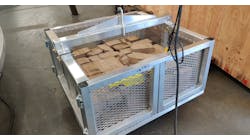

Based in Van Nuys, CA, Superior Industries calls itself “the largest manufacturer of aluminum wheels for passenger cars and light-duty vehicles in North America.” Its five plants in Fayetteville and Rogers, AR, Southfield, MI, and Chihuahua, Mexico, produce aluminum wheels for Ford Motor Co., General Motors Corp., Chrysler Group LLC, BMW, Mitsubishi, Nissan, Subaru, Toyota, and Volkswagen.

Currently, Superior Industries produces approximately 12.5 million wheels per year. The planned new operation would add 2 million to 2.5 million wheels to its annual capacity.

The wheelmaker’s unit shipments rose to 12.5 million in 2012, from 11.7 million units shipped in 2011. While Superior Industries had a 7% increase in unit sales for 2012, its net sales fell to $821.5 million from $822.2 million in 2011. It said the difference was due to declines in aluminum prices.

In its statement, Superior Industries said its 2012 decline in gross profit and margin percentage reflected manufacturing costs, in particular higher labor and maintenance costs.

Also, it said its manufacturing cost increase was related to higher sales volume, poor equipment reliability, and other problems that reduced operating efficiencies, especially at its older plants in the U.S. facilities.

Next steps

According to Steven J. Borick, Superior Industries chairman, CEO, and president, “The opportunities and challenges in our business have clarified the next steps to improve our operating returns.”

Borick indicated that the condition of Superior Industries’ manufacturing operations had impeded the company’s ability to take advantage of strong conditions in the North American automotive market.

“Superior remains the premier aluminum wheel manufacturer in a healthy and growing North American automotive market,” he said. “While our operations in Mexico consistently have performed at class-leading levels, it has been evident we are not currently positioned to participate fully in North American market growth.”

Thus, the company plans to build a new manufacturing operation somewhere in Mexico, “where significant light-vehicle assembly expansion has been announced or already is underway,” Borick said.

He said a specific plant site in Mexico has not been chosen, but groundbreaking is expected in midyear. Construction would be complete in about two years.

The chairman said cash on hand is adequate to fund the project, but Superior is evaluating credit options for the project.

Also, Superior said it would make improvements to its existing operations in the U.S. and Mexico. While it made capital investments of $23 million in 2012, which was more than 33% above the total for 2011, Superior said it plans to increase that total in 2013, “with a goal to improve process capability and operating efficiency, especially in the U.S.”